This is the second article in our series of Key Performance Indicators that all businesses need to understand, and we’ll be focusing on those all-important financial KPIs.

Making it personal

As we said in our first topic on customer satisfaction measures, we never advocate picking standard KPIs or going online to seek out a template set of measures which might be applicable to an industry or business vertical. Yes, we do think that it is useful to be aware of common industry-wide KPIs, but it is essential to create a specific set for your own business.

Why? Because these vital metrics will be there to track progress towards your own specific goals and objectives as part of your business strategy. No two organisations will have the same strategy, or the same goals and objectives. So it follows that they will not have the same success measures either.

The financial set of KPIs

In our first article, we looked at customer satisfaction KPIs and discussed how these would be found in every organisation – tailored to each organisation.

In the same way, financial KPIs will be found within every organisation, regardless of whether or not it is a profit-making entity. These measures tend to be well understood by all managers, and will usually fall into three categories as follows:

- Revenue (both booked and Sales Revenue)

- Profit (Gross Profit and Net Profit)

- Costs (cost of Sale and Operating Expenses)

Let’s look at each in more detail.

Revenue is defined as the income that an organisation derives from its operations before the costs of those sales are deducted. It’s also called sales turnover and appears as the top line item in a profit and loss account, from which costs, charges and expenses are deducted to arrive at the net income figure.

Profit – calculated by subtracting expenses from revenue, profit is the figure that most commercial organisations will focus on.

Costs – various costs are incurred in the course of doing business, and these can be fixed or variable, and directly incurred, or indirectly occurred. Cost management is key to creating a successful and profitable organisation, in order to minimise waste and to maximise profits or an operating surplus. Supporting measures can measure the effectiveness of this cost management.

Other important financial measures

There is actually a multitude of financial measures. These include:

Revenue Growth Rate

Revenue Growth Rate is an indicator of how well a company is able to grow its sales revenue over a given time period. While the revenue itself is presented as an actual number, the revenue growth rate is a percentage that compares the current sales figures (total revenue) with a previous period (typically quarter to quarter or year to year).

Total Shareholder Return (TSR)

Quite simply, this expresses how much of a return the business’s shareholders can expect to get from their investment, usually in the form of dividend payments (and possibly capital payments, or additional shares). It is calculated as a percentage of the total return against investment that is returned to each investor within a fixed period (usually a year.)

Economic Value Add (EVA)

EVA measures how much of a return a business makes, above that of what it needs to satisfy its shareholders. That means, a measure of how much economic profit the organisation can generate, which factors in the opportunity cost of the capital invested in it. The metric’s purpose is to assess whether organisational value has been generated – or lost, during a defined period of time.

Return on Investment (ROI)

This is another metric designed to assess the efficiency of an investment. Expressed as a percentage, it assesses net profit over a fixed time period, against the cost of that investment, and it allows an organisation to relate its profits to the capital that was invested to generate them. If the ROI is high, the investment is performing well.

Using financial KPIs

Each of these measures has its place within an organisation, and they may be considered for KPIs depending on what the organisation is actually trying to achieve.

Financial success needs to be proven for any entity to be economically viable, even if profit-generation is not its goal. For non-profits, any generated surplus may be reinvested back into service delivery projects, for example, rather than distributed to shareholders.

Making it easy

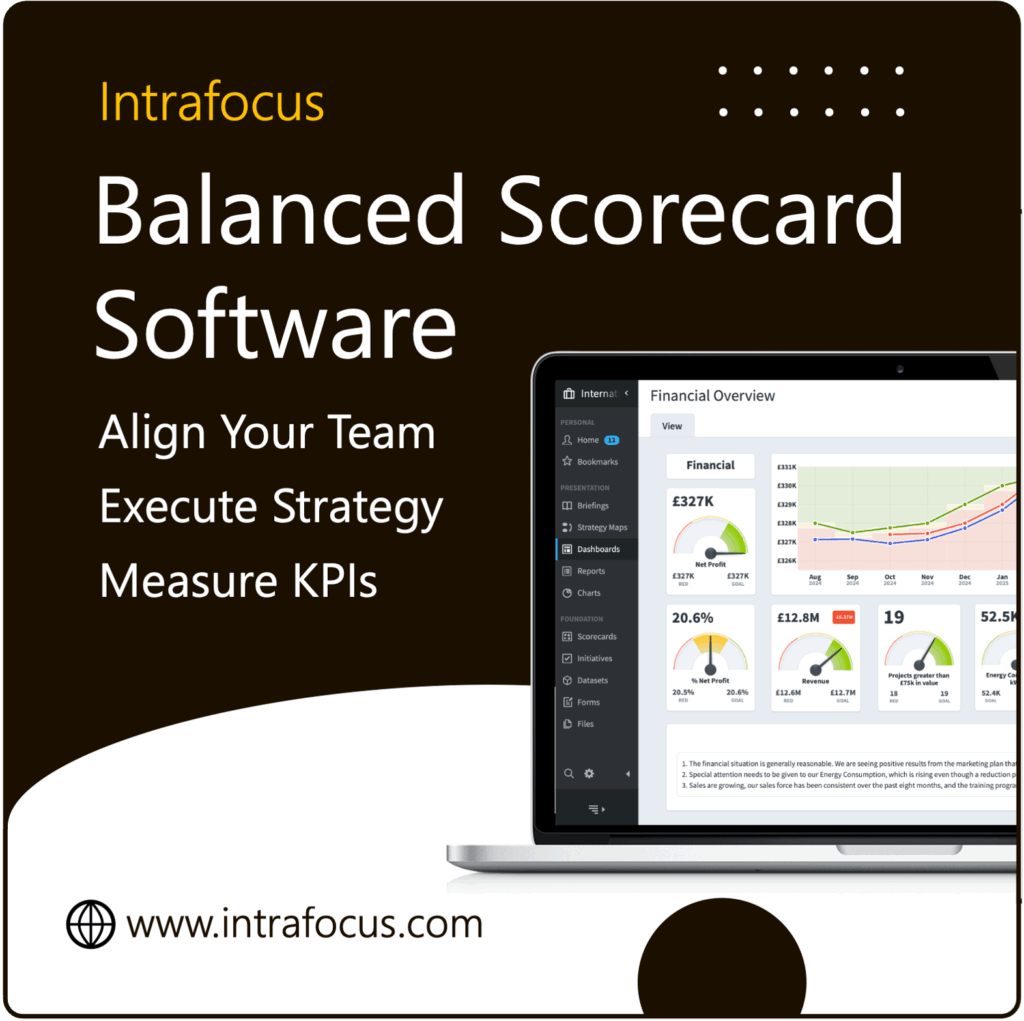

Automated software, such as QuickScore, now makes it easier than ever for organisations to generate even the most complex financial KPIs on a real-time basis, allowing stakeholders of all kinds to see current KPIs, and also to drill down to supporting data and information that explains the broader financial health of an organisation in a way that can drive strong management decision-making.

Further resources

Although we advocate business-specific KPIs, it is important for managers to be aware of the most common KPIs used within organisations. This kind of background knowledge can spark inspiration and prevent reinvention of the wheel.

For further reading about KPIs, we would also recommend The 75 measures every manager needs to know by Bernard Marr, which provides a highly readable, intuitive guide to KPI development for business managers.

Last but not least, the Intrafocus team is here for support, guidance and facilitation for your strategy needs. We tend to begin with a strategy workshop and can host this remotely as required. Please contact us to find out more.